Condo Insurance in and around Plano

Looking for outstanding condo unitowners insurance in Plano?

Quality coverage for your condo and belongings inside

Condo Sweet Condo Starts With State Farm

Committing to condo ownership is a big responsibility. You need to consider neighborhood needed repairs and more. But once you find the perfect condo to call home, you also need fantastic insurance. Finding the right coverage can help your Plano unit be a sweet place to call home!

Looking for outstanding condo unitowners insurance in Plano?

Quality coverage for your condo and belongings inside

State Farm Can Insure Your Condominium, Too

Things do happen. Whether damage from weight of ice, theft, or other causes, State Farm has fantastic options to help you protect your townhome and personal property inside against unexpected circumstances. Agent Kelly Cook would love to help you build a policy that is personalized to your needs.

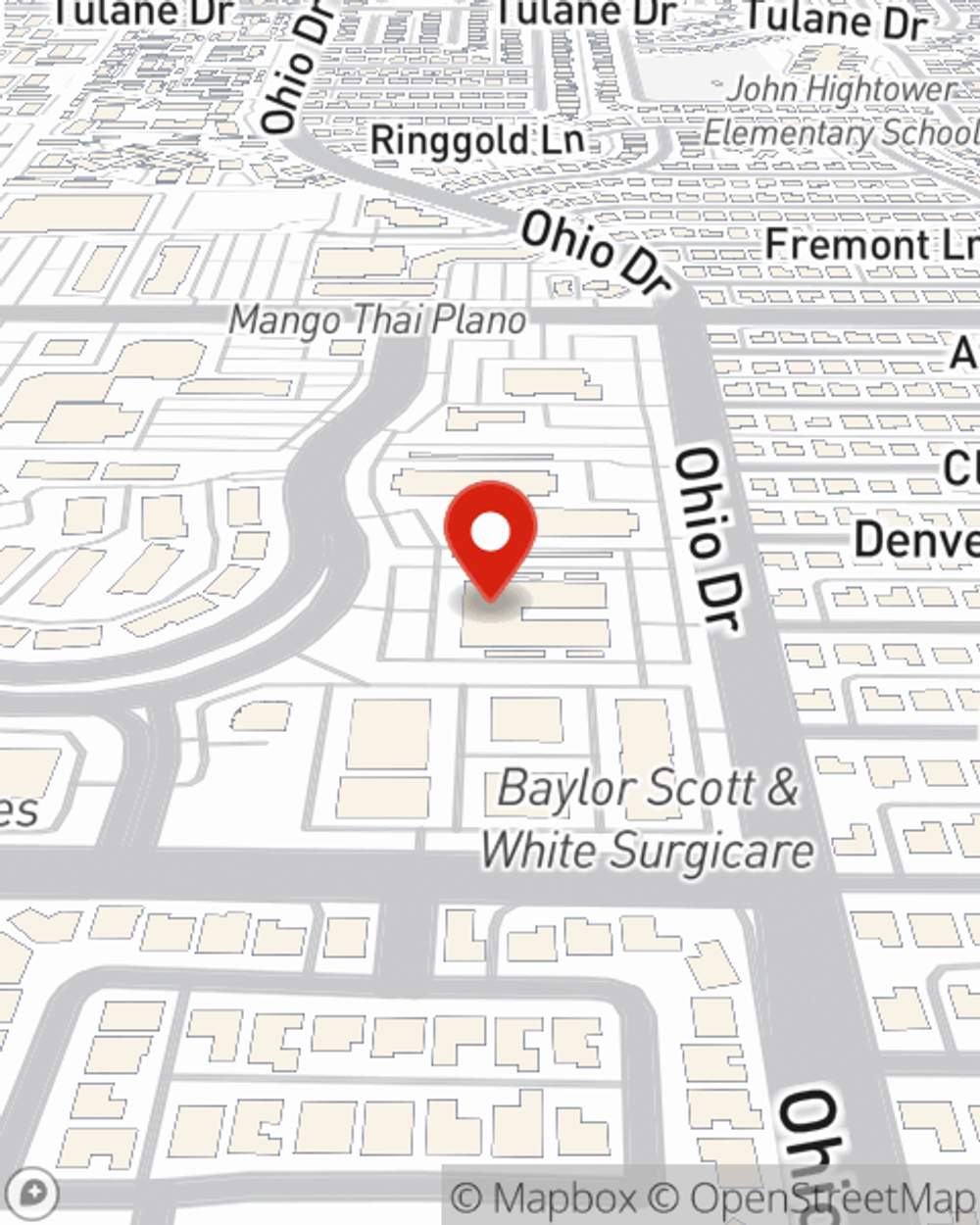

If you're ready to bundle or check out more about State Farm's terrific condo insurance, reach out to agent Kelly Cook today!

Have More Questions About Condo Unitowners Insurance?

Call Kelly at (972) 250-4700 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.