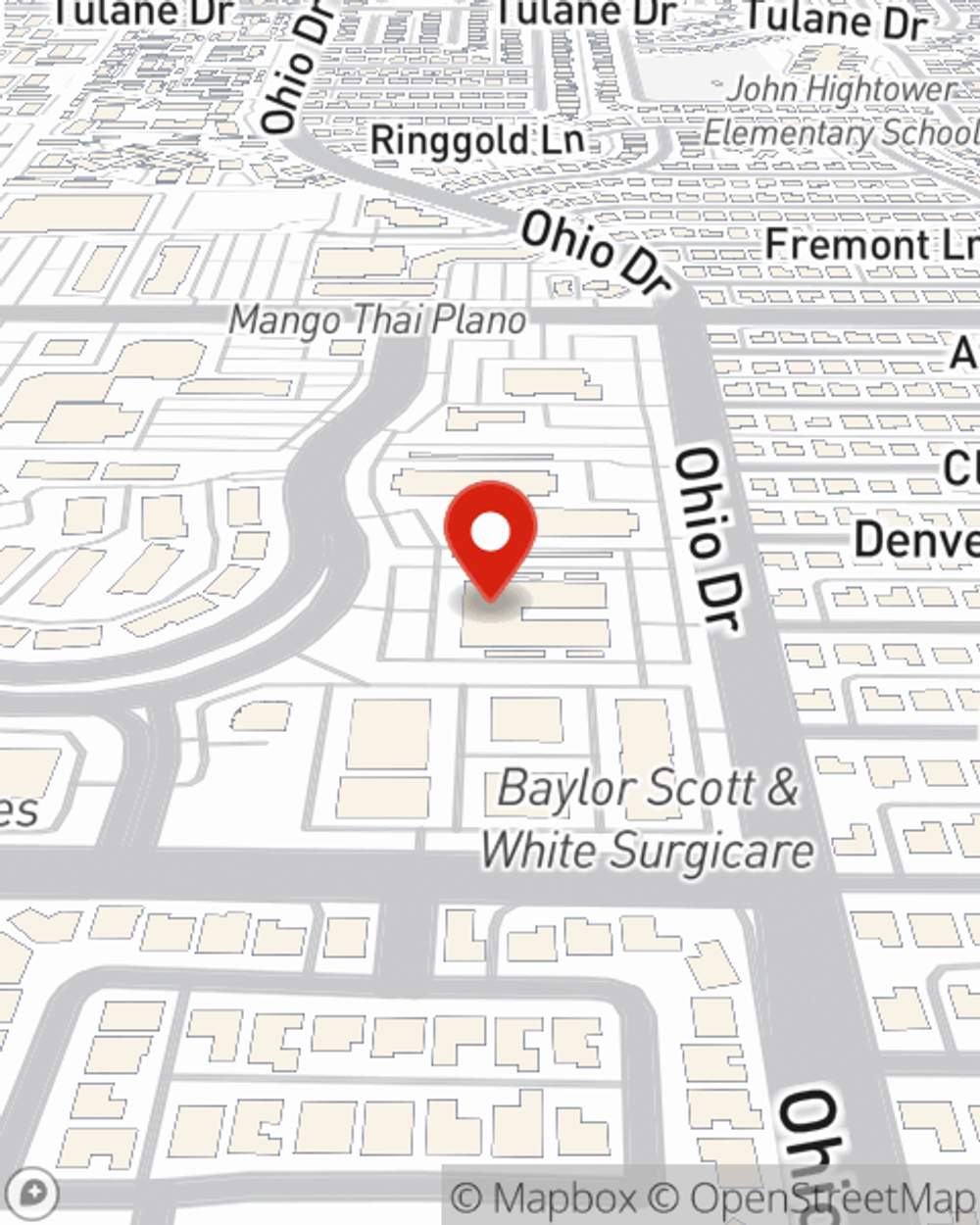

Renters Insurance in and around Plano

Renters of Plano, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your rented space is home. Since that is where you rest and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your books, kitchen utensils, laptop, etc., choosing the right coverage can help protect you from the unexpected.

Renters of Plano, State Farm can cover you

Coverage for what's yours, in your rented home

There's No Place Like Home

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a property or space, you still own plenty of property and personal items—such as a stereo, TV, desk, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why secure your belongings with renters insurance from Kelly Cook? You need an agent with a true desire to help you understand your coverage options and choose the right policy. With competence and skill, Kelly Cook stands ready to help you keep your belongings protected.

Don’t let the unknown about protecting your personal belongings make you unsettled! Call or email State Farm Agent Kelly Cook today, and explore the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Kelly at (972) 250-4700 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.